Startup India Registration

- Posted by SSdigitalBE

- On June 19, 2019

- 0 Comments

Startup India Scheme is an initiative of the Indian government, the primary objective of which is the promotion of startups, wealth creation, and employment generation.

Registration process

Business Incorporation

You must first incorporate your business as a Private Limited Company (Most preferred) or a Partnership Firm (Registered) or a Limited Liability Partnership (LLP) or One Person Company.

This is a normal process, you will get Incorporation Certificate, PAN and other required compliances.

Registration with Startup India

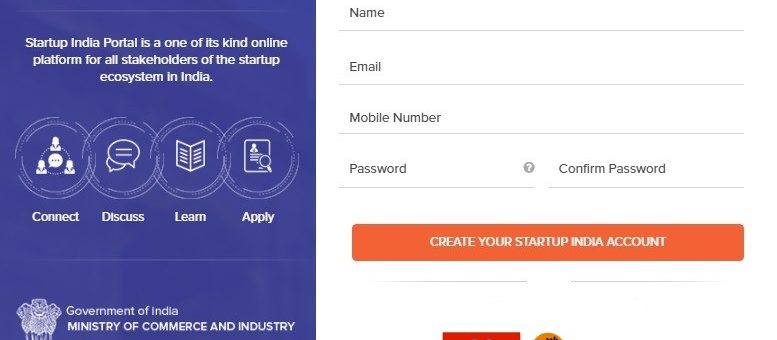

After incorporation you need to get yourself registered as a startup. The entire process is simple and online. All you need to do is log on to the https://www.startupindia.gov.in/ and fill up the form with details of your business and upload certain documents.

Upload Documents (in PDF format only)

a) A letter of recommendation/support

A letter of recommendation must be submitted along with the registration form. Any of the following will be valid-

(i) A recommendation (regarding innovative nature of business) from an Incubator established in a post-graduate college in India , in a format specified by the Department of Industrial Policy and Promotion (DIPP); OR

(ii) A letter of support by an incubator, which is funded (in relation to the project) by Government of India as part of any specified scheme to promote innovation; OR

(iii) A letter of recommendation (regarding innovative nature of business), from an Incubator, recognized by the Government of India in DIPP specified format; OR

(iv) A letter of funding of not less than 20% in equity, by any Incubation Fund/Angel Fund/Private Equity Fund/Accelerator/Angel Network, duly registered with SEBI that endorses innovative nature of the business; OR

(v) A letter of funding by Government of India or any State Government as part of any specified scheme to promote innovation; OR

(vi) A patent filed and published in the Journal by the Indian Patent Office in areas affiliated with the nature of the business being promoted.

b) Certificate of Incorporation/Registration

You need to upload the certificate of incorporation of your company/LLP (Registration Certificate in case of partnership)

c) Description of your business in brief

A brief description of the innovative nature of your products/services.

Answer whether you would like to avail tax benefits

Startups are exempted from income tax for 3 years. But to avail these benefits, they must be certified by the Inter-Ministerial Board (IMB). Start-ups recognized by DIPP, Govt. of India can now directly avail IPR related benefits without requiring any additional certification from IMB.

Self-certify that you satisfy the following conditions

a) You must register your new company as a Private Limited Company, Partnership firm or a Limited Liability Partnership

b) Your business must be incorporated/registered in India, not before 5 years.

c) Turnover must be less than 25 crores per year.

d) Innovation is a must– the business must be working towards innovating something new or significantly improving the existing used technology.

e) Your business must not be as a result of splitting up or reconstruction of an existing business.

Get Registration Number:

On applying you will immediately get a recognition number for your startup. The certificate of recognition will be issued after the examination of all your documents.

Please be aware that, If on subsequent verification, it is found that the required document is not uploaded/wrong document uploaded or a forged document has been uploaded then you shall be liable to a fine of 50% of your paid-up capital of the startup with a minimum fine of Rs. 25,000.

0 Comments