Presumptive Income & its Taxation – under section 44AD

- Posted by SSdigitalBE

- On June 19, 2019

- 0 Comments

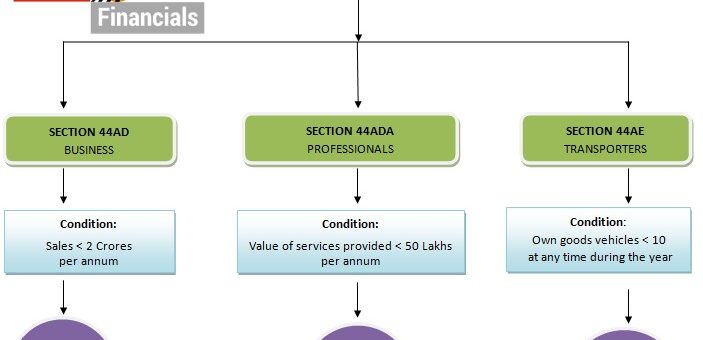

To reduce the tax burden and to provide relief from tedious work of maintaining books of Accounts to small tax assessees, the government of India has incorporated a scheme of presumptive taxation. There are three section as under:

- Section 44AD: for trading, civil construction or any other business

- Section 44AE: for taxpayers engaged in business of plying, leasing or hiring of trucks

- Section 44ADA: for professionals

Features u/s 44AD:

- Your gross receipts or turnover of the business for which you want to avail this scheme should be less than Rs 2 crore.

- Your Net Income is estimated to be 8% of the gross receipts of your business. But From FY 2016-17 onwards, if gross receipts are received through digital mode of payments , then Net Income is estimated at 6% of such gross receipts and for cash receipts , rate is same at 8% of such cash receipts.

- This scheme is allowed to an individual, a HUF or a partnership firm. It is not available to a Company.

The scheme cannot be adopted by the taxpayer, if he has claimed deduction under section 10, 10A, 10B, Section 10BA, or Section 80HH to 80RRB in the relevant year.

Eligible Businesses: The taxpayer may be in any business – retail trading or wholesale trading or civil construction or any other business to avail this scheme. But this method of income computation is NOT applicable to:

Agency business, Income from commission or brokerage, Business of plying, hiring or leasing goods carriage (see section 44AE), Professionals (see Sec 44ADA)

Features u/s 44AE:

- You should be in the business of leasing or hiring trucks.

- You should not own more than 10 goods carriages at any time during the year. Include carriages taken on hire purchase or on instalments.

- You may be an individual, HUF, Company or partnership firm – scheme is allowed to all taxpayers.

- Net Income from a heavy goods vehicle (including any goods carriage) will be assumed as Rs 7,500 per month for each vehicle beginning assessment year 2015-16.

Here ‘Goods carriage’ means any vehicle used only for the carriage of goods. ‘Heavy goods vehicle’ means a goods carriage whose standalone weight (without loading goods) is more than 12,000 kgs.

Features u/s 44ADA:

The benefit of Presumptive tax rates were only available to Businesses. But now this benefit has been extended to professionals also .It will be applicable to the Professionals whose total gross receipts does not exceed Rs 50 lakhs in a financial year.

Presumptive Tax Rate: The income of the professionals opting for this scheme would be assumed at 50% of the total Gross receipts for the year.

The scheme is applicable only to a resident assesse who is an individual, HUF or Partnership but not LLP (Limited Liability Partnership Firm).

Applicable on all three sections:

- You must be a Resident in India.

- You don’t have to maintain books of accounts of this business.

- No business expenses are allowed to be deducted from the net income. Depreciation is also not deductible. Even though depreciation is not allowed as a deduction is written down value (WDV) of the assets shall be considered as if depreciation has been allowed.

- The taxpayer can voluntarily declare a higher income and pay tax on it. In case the taxpayer chooses to declare lower income, he shall have to maintain books of accounts and get them audited.

- You have to pay 100% Advance Tax by 15th March for such a business. No need to comply with requirement of quarterly instalments due dates (June, sep, Dec) of advance tax.

0 Comments