How to rectify mismatches between Form 16 and Form 26AS

- Posted by SSdigitalBE

- On August 21, 2019

- 0 Comments

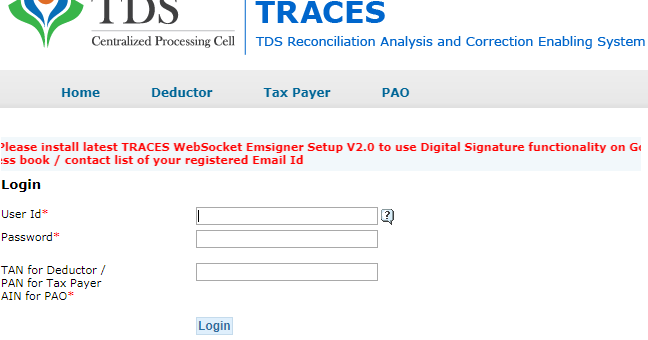

Most salaried people think that the Form 16 is all that is needed to file income tax returns. However, according to experts, it is important to ensure that there is no discrepancy in the information that the IT department has in its possession and what you are providing through ITR filing. To do that you […]

Read More