Documents and information for filing Income Tax Return

- Posted by SSdigitalBE

- On July 19, 2018

- 0 Comments

- Income Tax

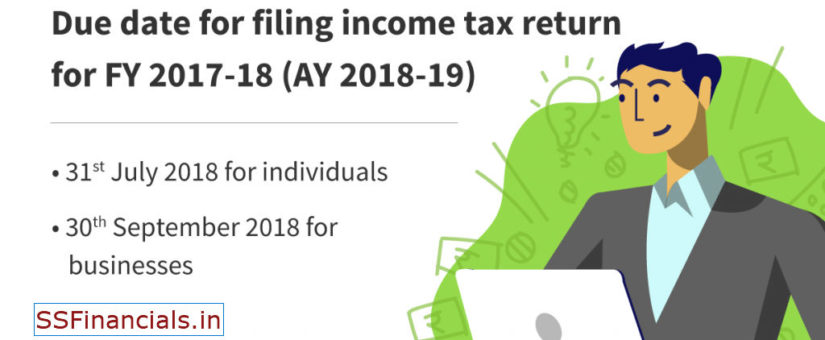

It is a good idea to keep all the necessary documentary proof handy while filing your income tax return without which filing your income tax return could be difficult. You need to file income tax return well in time as you may face a penalty of Rs 10,000 if you fail to file income tax return. It becomes all the more important to file it on time this year as there is a penalty for missing the deadline.

Chartered accountants are advising taxpayers to collect all the documents related to their income earned during the financial year. This year, the income tax department has asked taxpayers using ITR1 to file their return to provide a break-up of their gross salary income and income earned from one house property during the FY 2017-18.

Here is the list of documents you must keep in handy while filing your ITR :

1. Salary Slips

Salaried taxpayers are required to provide information of allowances such as house rent allowance, transport allowance which all are taxable apart from perquisites and profit in lieu of salary.

If you are getting proper salary slips from your employer, you can find all these details in your salary slips. From the salary slips, you can add each allowance received during the year and then calculate the taxability portion of it. If you have received HRA in the last FY and paid rent, then the taxable portion of that will be calculated based on certain conditions. You can use the online available HRA calculator and compute taxable amount.

The allowance which you received has the different calculation of tax, some allowances will be fully taxable, while some are partially taxed. You can find all of this information in your salary slips.

Special allowance received in your hands during the last FY will be fully taxable. Transport allowance received during FY 2017-18 will be tax-exempt for maximum up to Rs 19,200 in a year. However, from FY 2018-19, a standard deduction of Rs 40,000 will be available in lieu of transport allowance and medical reimbursement.

2. Form-16

Form-16 is a TDS certificate issued to you by your employer to provide details of the salary paid to you and TDS deducted on it if any. If you are a salaried person, this is one of the most important documents for you to file your ITR. It is mandatory for your employer to issue Form-16 if your employer has deducted TDS from your salary. If no TDS is deducted from your salary, then you can request your employer to provide you the same.

In filing income tax return for FY 2017-18, ITR form-1 requires salaried taxpayers to provide the salary break-up, having Form-16 makes it easier to get that information.

Form-16 consists of two parts: Part-A and Part-B. Part-A consists of all the details of the tax deducted by your employer during the year. In addition to the details of the tax deducted from your salary, it also consists of the details of your Permanent Account Number (PAN), PAN and TAN of your employer. Part-B of the form consists of your gross salary break-up details such as exempt allowances and perquisites. Details like perquisites, profit in lieu of salary which is taxable in your hands can be found in Part-B Form-16.

While receiving Form-16, make sure that the PAN mentioned on it is yours. If there is any discrepancy, then you must bring this to your employer’s notice. Your employer will rectify the mistakes in Form-16 and issue you a revised form.

3. Interest certificates from banks and post office

One must either get the interest certificates from the bank/s and/or post office branch to know the total interest earned, in case no TDS has been deducted. Interest received from savings bank account, post office savings account, recurring deposits, and fixed deposits are taxable. Therefore,

If you do not get certificates of interest, make sure your account passbook is updated and shows details regarding the interest credited to your account till March 31, 2018.

Individuals can claim deduction under section 80TTA on the interest received up to Rs 10,000 in an FY from the savings bank account and post office savings account. Any interest received above Rs 10,000 will be chargeable to tax.

4. Form-16A/Form-16B/Form-16C

If TDS deducted on the payments other than salaries such as interest received from fixed deposits, recurring deposits etc. over the specified limits as per the current tax laws, your bank (in this case) will issue you Form-16A providing you the details of the amount of TDS deducted.

On the other hand, if you have sold your property, then the buyer will issue you Form-16B showing the TDS deducted on the amount paid to you.

If you are a landlord and earning rental income, then you should ask your tenant to provide you Form-16C for providing the details of TDS deducted on the rent received by you. As per the current laws, an individual is required to deduct TDS if the monthly rent is more than Rs 50,000. Further, you can check 26AS also for the TDS details.

5. Form 26AS

Form 26AS is your consolidated annual tax statement. This is like your tax passbook which has information of all the taxes that has been deposited against your PAN. These include:

a) TDS deducted by your employer,

b) TDS deducted by banks if the interest income in FY 2017-18 exceeds Rs 10,000,

c) TDS deducted by any other organisation for the payments that have been made to you,

d) Advance taxes deposited by yourself during the FY 2017-18,

e) Self-assessment taxes paid by you.

One can download Form 26AS from the TRACES website. To download your Form-26AS, you can log in to your account on the e-filing website, www.incometaxindiaefiling.gov.in. Once logged in, click on ‘View 26AS (Tax Credit)’ under the ‘My Account’ tab. The website will redirect you to the TRACES website to download the form.

You should ensure that all the taxes deducted in FY 2017-18 are reflecting against your PAN in Form-26AS. In case of a mismatch, you should ask the deductor to rectify the mistake. If the mismatch is not corrected, you won’t be able to claim tax-credit for that TDS deduction.

6. Tax-saving investment proofs

All the tax-saving investments and expenditures incurred by you under section 80C, 80CCC and 80CCD(1) during FY2017-18 can help you lower your tax liability. The maximum tax-break you can claim under these three sections cannot exceed Rs 1.5 lakh in a financial year.

The most common available tax breaks under section 80C are as follows:

a) Employees Provident Fund (EPF)

b) Public Provident Fund (PPF)

c) Investments in ELSS schemes of mutual funds

d) Life insurance premium paid

e) National Pension System (NPS) etc.

Click here to know all the investments that are eligible for tax-break under section 80C

Apart from investments, there are certain expenditures that are also eligible for tax benefits under section 80C. Examples of these expenditures include home loan principal repayment, tuition fees paid for your children etc. Click here to know all expenditures that can help you save tax under section 80C.

7. Deductions under section 80D to 80U

Apart from tax-saving investments and expenditures under section 80C, there are certain expenses on which you can claim deductions under different sections of the Income-tax Act. For instance, health insurance premium paid in the FY 2017-18 is eligible for deduction under section 80D of the Act for maximum up to Rs 25,000 in a year.

If you have paid for the health insurance premium of your parents, then you can claim an additional deduction of Rs 25,000 or Rs 30,000 depending on your parents’ age. If your parents’ age is below 60 years, you can claim the additional deduction of Rs 25,000. If age is 60 years or above, then you can claim an additional deduction of Rs 30,000.

Similarly, if you have paid any interest on the education loan, you can claim deduction under section 80E. There is no maximum limit on the amount of interest paid on the education loan.

8. Home loan statement from bank/NBFC

If you have taken a home loan from a bank or any other financial institution, don’t forget to collect the loan statement. It will provide you the break-up details of how much principal and interest has been repaid by you.

Interest repaid on the home loan can lower your tax liability under section 24. The maximum amount one can claim under section 24 is Rs 2 lakh. You will be required to provide the amount of interest repaid in the ITR form along with the rental income earned from that house property if any. If the said house property is used for the self-occupation purpose, then also you can claim deduction under section 24.

9. Capital gains

If you have earned some capital gains from the sale of property and/ or mutual funds, then you will be required to report these gains in your income tax return (ITR).

To compute capital gains (long-term or short-term) on the sale of house property, land or building one would require the purchase deed and sale deed of the said property. In case of capital gains accrued on the sale of mutual funds and/or shares, one would require statements from mutual fund houses and/or brokers.

One should remember that equity shares and equity-oriented mutual funds sold on or before 31 March 2018, after holding them for more than a year, will remain exempt from tax. From April 1, 2018, the sale of equity shares and equity-oriented mutual funds, held for at least a year, will be chargeable at the rate of flat 10 percent if the gain amount exceeds Rs 1 lakh. However, capital gains accrued till January 31, 2018, will be grandfathered as per the new rules.

10. Aadhaar card

Providing Aadhaar details is mandatory to successfully file your income tax return. According to section 139AA of the Income-tax Act, an individual is required to provide his/her Aadhaar details while filing the return of your income.

If you have not received your Aadhaar card yet but have applied for it, then you would be required to provide an enrolment ID in your tax returns.