Presumptive Income & its Taxation – under section 44AD

- Posted by SSdigitalBE

- On June 19, 2019

- 0 Comments

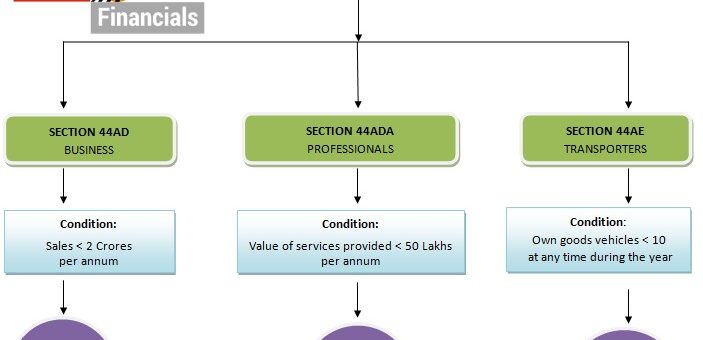

To reduce the tax burden and to provide relief from tedious work of maintaining books of Accounts to small tax assessees, the government of India has incorporated a scheme of presumptive taxation. There are three section as under: Section 44AD: for trading, civil construction or any other business Section 44AE: for taxpayers engaged in business […]

Read More