Documents and information for filing Income Tax Return

- Posted by SSdigitalBE

- On July 19, 2018

- 0 Comments

- Income Tax

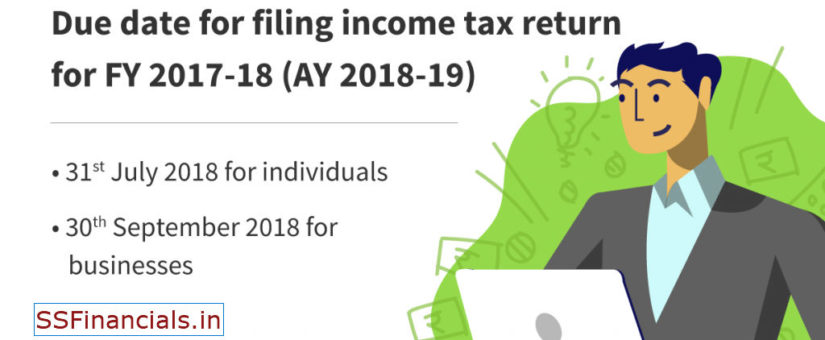

It is a good idea to keep all the necessary documentary proof handy while filing your income tax return without which filing your income tax return could be difficult. You need to file income tax return well in time as you may face a penalty of Rs 10,000 if you fail to file income tax […]

Read More